Essential Legal Documents for Selling a Business: A Comprehensive Guide

Selling a business is a significant endeavor that involves intricate legal processes and the preparation of numerous documents to ensure a smooth and legally compliant transaction. This comprehensive guide outlines the essential legal documents needed to sell a business, highlighting their importance and guiding sellers through the preparation process. We will integrate authoritative .gov, .edu, and Wikipedia links to provide additional resources and enhance the credibility of the information presented.

Introduction

The sale of a business requires careful planning and attention to legal details to protect the interests of both the seller and the buyer. Understanding the legal documents involved is crucial for a transparent and effective sale process. These documents not only facilitate the sale but also help in addressing any disputes that may arise post-sale.

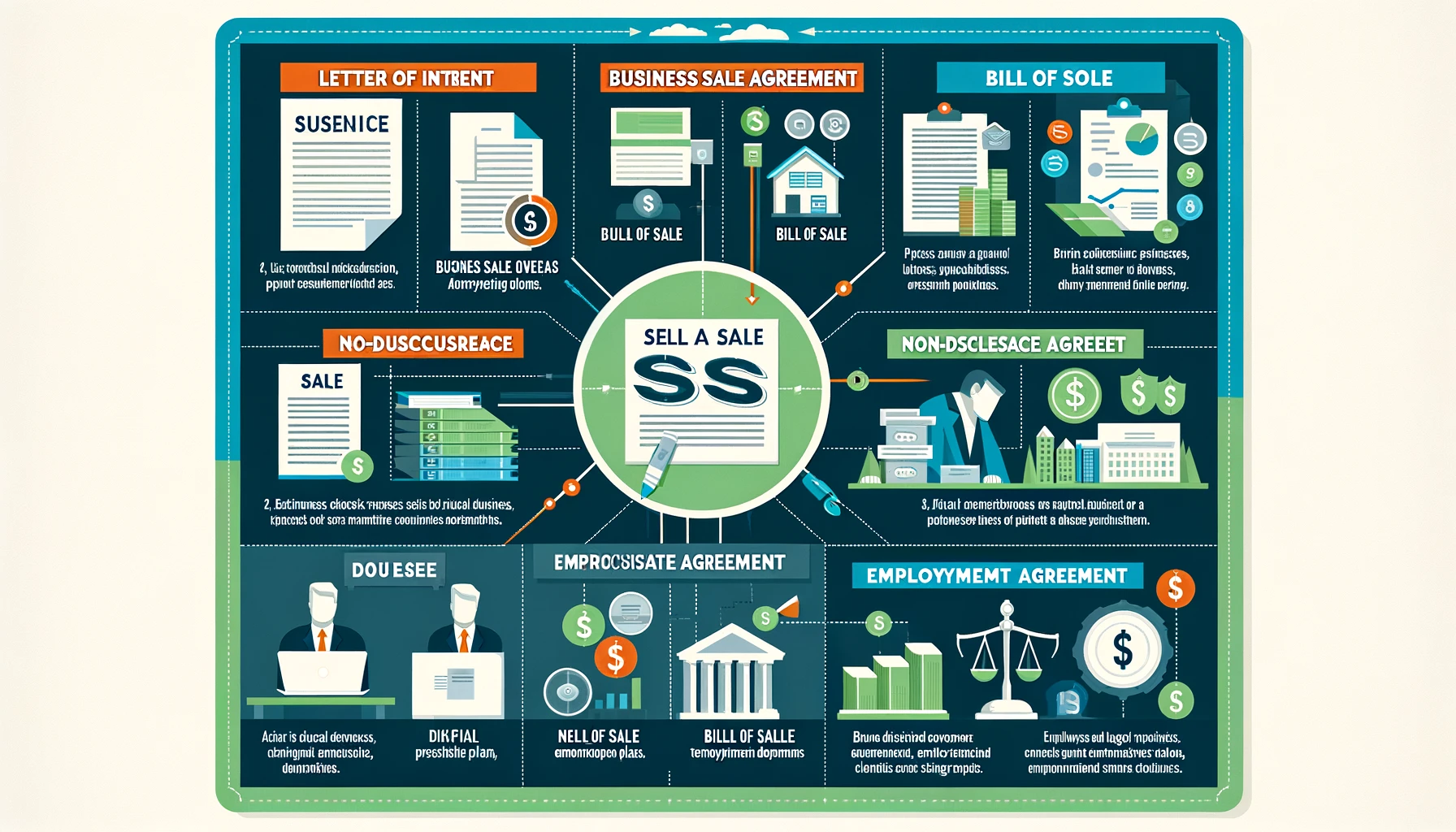

Key Legal Documents Needed to Sell a Business

1. Letter of Intent (LOI)

An LOI is a preliminary agreement between the buyer and the seller, outlining the basic terms of the sale. It serves as a foundation for negotiations and is typically non-binding, except for certain provisions such as confidentiality. The U.S. Small Business Administration (SBA) offers guidance on drafting initial agreements and understanding their implications.

2. Business Sale Agreement

The Business Sale Agreement is the central document in the sale process, detailing the terms and conditions of the sale, including the purchase price, payment terms, assets included in the sale, liabilities being assumed, and any contingencies. This document legally binds both parties to the transaction.

For more information on drafting a Business Sale Agreement, refer to resources available on FindLaw.

3. Due Diligence Documents

Due diligence is a critical phase where the buyer reviews the financial, legal, and operational aspects of the business. Essential documents for this process include:

Financial statements and tax returns

Contracts and leases

Licenses and permits

Employment records

The Internal Revenue Service (IRS) provides comprehensive tax-related information beneficial for due diligence.

4. Non-Disclosure Agreement (NDA)

An NDA protects confidential information shared during the sale process. It prevents both parties, especially potential buyers, from disclosing sensitive information about the business. Templates and guidelines for NDAs can be found on legal resource websites like Cornell Law School's Legal Information Institute.

5. Bill of Sale

A Bill of Sale provides proof of the transaction and transfers ownership of the business assets from the seller to the buyer. It specifies the assets being sold, including inventory, equipment, and intellectual property.

6. Non-Compete Agreement

A Non-Compete Agreement may be requested by the buyer to prevent the seller from starting a new, competing business within a certain timeframe and geographic area. This agreement ensures the buyer’s protection from direct competition.

7. Employment Agreements and Transition Plans

These documents outline the terms under which key employees will remain with the business post-sale, ensuring a smooth transition. Transition plans detail how the seller will assist the buyer during the changeover period.

The Department of Labor (DOL) offers insight into employment laws that may affect these agreements.

8. Closing Documents

Closing documents finalize the sale and transfer the business officially to the buyer. These may include a final purchase agreement, closing statements detailing the final financial transactions, and any legal documents required to transfer business ownership.

Legal and Financial Considerations

When selling a business, it's crucial to consider legal and financial implications, including tax obligations and legal compliance. Consulting with professionals such as accountants, lawyers, and tax advisors is essential. Resources like the American Bar Association provide access to legal professionals specializing in business sales.

Create & Review Your Contracts 10x Quality and Ease

Lawyer-level AI handles all your contract needs, with real lawyers providing safeguarding support

Conclusion

Selling a business involves numerous legal documents to ensure a legally compliant and smooth transaction. From the initial letter of intent to the final closing documents, each plays a vital role in protecting the interests of both the buyer and the seller. Utilizing the resources provided by authoritative .gov, .edu, and Wikipedia links, along with professional advice, can greatly aid in navigating the complexities of selling a business.

Remember, this guide serves as a starting point. The specifics of your business sale may require additional documents and considerations. Always consult with legal and financial professionals to tailor your approach to your unique situation.