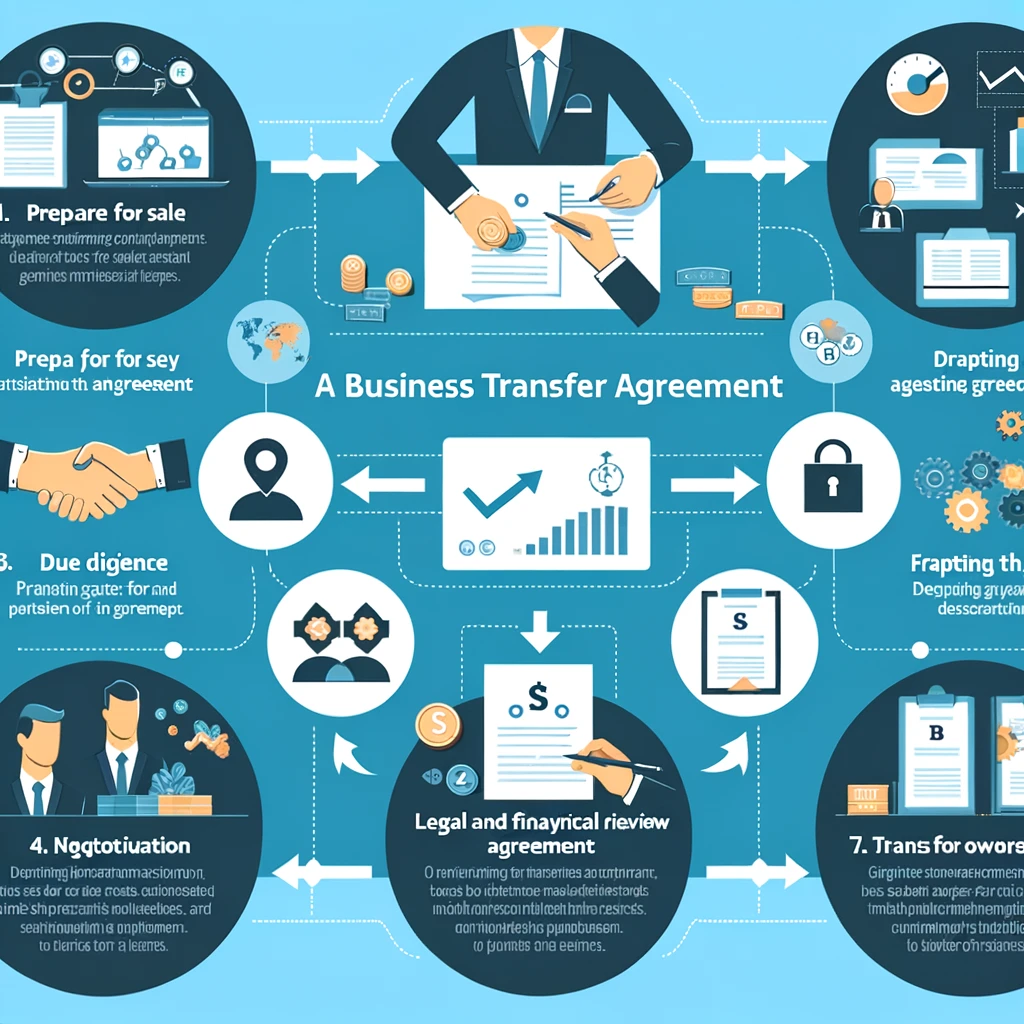

Mastering Business Transfer Agreements: A Complete SEO Guide

When it comes to buying or selling a business, a Business Transfer Agreement (BTA) plays a pivotal role in ensuring a smooth transition and safeguarding the interests of all parties involved. This comprehensive guide delves into the nuances of BTAs, offering insights into their structure, importance, and legal considerations, supplemented with authoritative resources from .gov, .edu, and Wikipedia links to enhance credibility and understanding.

Understanding Business Transfer Agreements

A Business Transfer Agreement, also known as a Business Purchase Agreement or Asset Purchase Agreement, is a legally binding document that outlines the terms and conditions under which a business's ownership is transferred from the seller to the buyer. It covers every aspect of the sale, including the assets, liabilities, and terms of transfer. The U.S. Small Business Administration (SBA) provides a wealth of resources on the steps involved in buying an existing business, highlighting the critical role of a comprehensive BTA.

Key Components of a BTA

A typical BTA includes several essential elements:

Parties Involved: Clearly identifies the buyer and seller.

Assets and Liabilities: Lists all assets being transferred and liabilities being assumed.

Purchase Price and Payment Terms: Specifies the sale price and the terms of payment.

Warranties and Indemnities: Offers guarantees about the business's current state and indemnifies the parties against future liabilities.

Conditions Precedent: Lists conditions that must be met before the transaction can be finalized.

Termination Clauses: Outlines circumstances under which the agreement can be terminated.

For an in-depth understanding of these components, Investopedia's guide on Asset Purchase Agreements provides a detailed breakdown.

Legal Considerations

Navigating the legal landscape of a business transfer requires careful consideration of local and federal laws. The Uniform Commercial Code (UCC), as detailed on Cornell Law School's Legal Information Institute website, governs commercial transactions in the United States and offers a legal framework for BTAs. Additionally, specific industries may have regulatory bodies that approve or review the transfer of business ownership, emphasizing the importance of due diligence and legal compliance.

The Importance of Due Diligence

Due diligence is a critical phase in the business transfer process, allowing the buyer to assess the business's financial performance, legal standing, and operational efficiency. This process includes reviewing financial statements, contracts, employee records, and compliance with laws. The Federal Trade Commission (FTC) offers guidance on compliance with federal laws, which is crucial for due diligence.

Financial Analysis

A thorough financial analysis reveals the business's health and helps in valuing the business accurately. This includes reviewing past financial statements, tax returns, and forecasts. Resources like the Financial Accounting Standards Board (FASB) provide standards for financial reporting that can be useful in evaluating the business's financial records.

Legal and Regulatory Compliance

Ensuring that the business complies with all legal and regulatory requirements is vital to avoid future liabilities. This involves checking for compliance with employment laws, environmental regulations, and industry-specific regulations. The Environmental Protection Agency (EPA) and the U.S. Department of Labor offer resources on environmental and employment regulations, respectively.

Crafting a BTA: Best Practices

When drafting a Business Transfer Agreement, clarity, and attention to detail are paramount. Here are some best practices:

Employ Professional Assistance: Engaging legal and financial professionals ensures that the agreement is comprehensive and compliant with all relevant laws.

Negotiate Terms Clearly: Open negotiation on terms like price, assets included, and transition support can prevent misunderstandings.

Customize the Agreement: Each business transfer is unique, so customize the agreement to reflect the specific terms and conditions of the deal.

Case Studies and Examples

Examining real-world examples of Business Transfer Agreements can provide practical insights into how different scenarios are handled. While specific case studies may be confidential, academic institutions like Harvard Business School often publish studies on business acquisitions that can offer valuable lessons.

Create & Review Your Contracts 10x Quality and Ease

Lawyer-level AI handles all your contract needs, with real lawyers providing safeguarding support

Conclusion

A well-structured Business Transfer Agreement is crucial for the successful transfer of business ownership. It protects the interests of both the buyer and seller, ensures compliance with legal standards, and facilitates a smooth transition. By understanding the key components, legal considerations, and due diligence required, parties can navigate the complexities of business transfers with confidence.

Leveraging resources from .gov, .edu, and Wikipedia, this guide aims to empower entrepreneurs, business owners, and legal professionals with the knowledge needed to master Business Transfer Agreements, ensuring a secure and efficient business transfer process.